2022, A Unique Year

With 2022 drawing to a close, it can be said that financial markets in 2022 have faced difficulties unlike they have seen for some time.

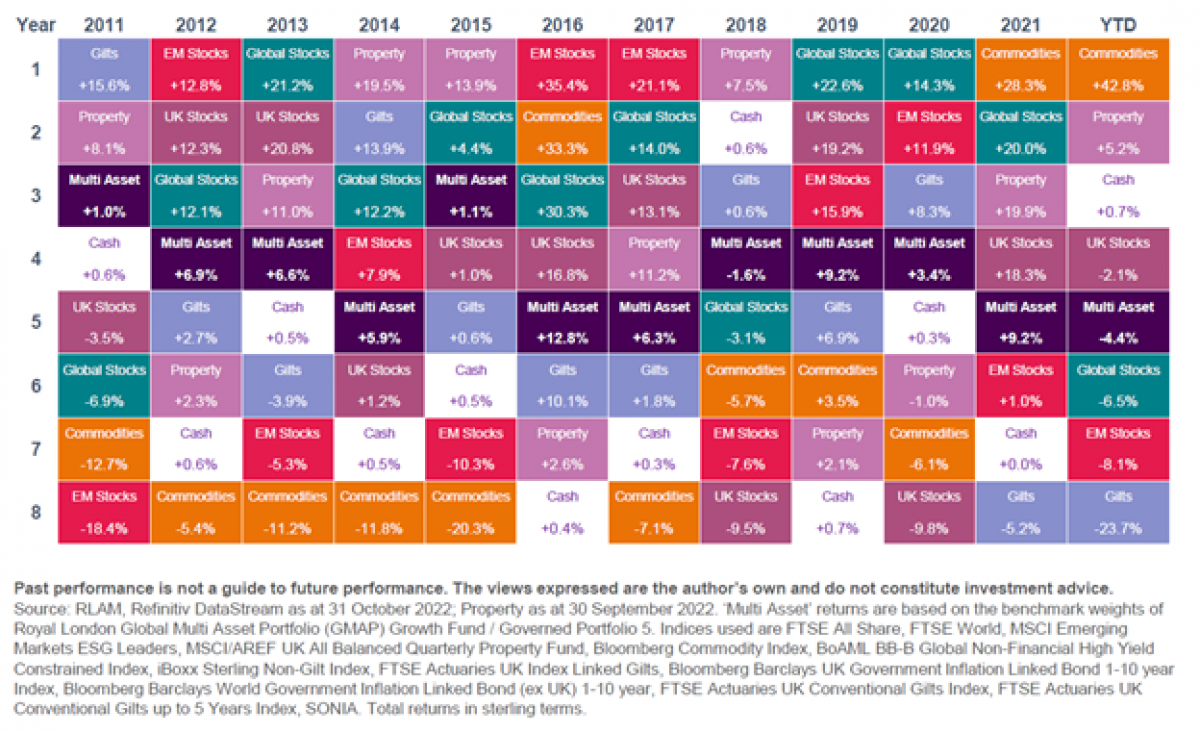

The year’s distinguishing characteristic is that volatility and significant negative performance has been experienced by the majority of asset classes, notably those asset classes that have historically been held to mitigate volatility.

In the period beginning 1st January 2022 and ending 31st October 2022, Global Stocks were down 6.5%, which if they were to end the year at that level, would represent the worst year’s performance since 2011.

In the same period, Gilts, which are UK Government issued bonds, have fallen a staggering 23.7%. This would represent the first time since at least 14 years that both asset classes had returned negative performance in the same calendar year.

Such a simultaneous fall in stocks and bonds is rare. When stock prices fall as a result of a weakening economy, bond prices usually rise owing to expectations of interest-rate cuts, which central banks use as a tool to boost the economy. Conversely, stocks often benefit from a stronger economy, while bonds sell off. The double dip this time is driven by surging inflation, expected interest-rate rises and a belief that the economic situation could deteriorate.

Utilising a multi-asset investment approach has previously allowed fund managers to control the amount of risk a portfolio is exposed to by altering the proportion of the fund that is split between fixed interest securities and equities. The higher proportion of fixed interest holdings that a portfolio holds would generally lead to less volatility in the value of the investments, which effectively results in a lower risk investment portfolio.

Unfortunately, that has not been the case in 2022, where fixed interest holdings, most notably Gilts, have not provided the security that investors would have come to expect.

However, the ‘patchwork quilt’ produced by Royal London still provides a positive reminder that a multi-asset approach with a focus on global equities will historically provide positive returns.

It is apparent that 2022 has been a uniquely difficult year, where the economic cycle has been hugely impacted by the Russian invasion of Ukraine. However, long-term investors will have benefitted from the largely positive performance of the past decade, and those who have invested over the past 24 months but are investing for the long-term, can take comfort in past market cycles. Data produced by Vanguard shows that the average bear market – a market decline of 20% from the previous peak – tends to last 1.1 years, whilst a bull market – where prices are rising – last an average of 5.9 years.

Please be aware that the value of investments linked to the stock market and the income from them, may rise or fall depending on market conditions and that you may not always recoup your initial investment. In addition past performance should not be seen as an indication of future returns.