Gen Z are the “investing generation.” Here’s how to help your kids build their wealth

A recent study shows 4 in 5 members of Gen Z have begun their investing journey before they’re 21. Here’s how to help your children grow their wealth.

Generation Z, also known as “Gen Z”, are the age group born between 1997 and 2012 – meaning these individuals are likely to be aged between 11 and 26 as of 2023.

You may have children and grandchildren who fall into this age bracket, and whether they know it or not, these ages are extremely formative when it comes to financial skills.

You may have given your children or grandchildren a set pocket money allowance when they were younger, designed to teach them the value of currency and give them the skills to manage a budget. “If you want something you can’t afford, then save up for it” – this, and many others, are financial lessons you may have repeated to your loved ones again and again.

You may be surprised to learn that, according to a survey published by FTAdviser, Gen Z are keen investors on the whole. The survey reports 4 in 5 members of Gen Z “have already started investing by the time they turn 21”.

Worryingly, though, the research also revealed that “accessing financial information on social media, as well as new investing apps and cryptocurrencies, were important factors in Gen Z’s decision to invest”.

If you have Gen Z children or grandchildren, it’s vital to be aware that they may already be investing (or planning to invest) their money from an early age. It could be helpful to guide them on their wealth journey – especially with the prevalence of misinformation on social media and other online platforms.

Here’s how to help your Gen Z children and grandchildren build their wealth through investing.

Listen to your kids’ financial goals

You will have dreams and goals that inform how you manage your money – and your Gen Z family members are no different.

Yet while your goals might now focus on a precise retirement age, drawing from long-term investments, and later-life planning, your Gen Z children and grandchildren are just getting started in the young adult world.

So, the first step towards helping them invest for the future is to listen to their life goals. These goals will inform the way your loved ones invest, the time frame, and their appetite for risk.

Your Gen Z children and grandchildren’s goals might centre around:

- The type of industry they want to work in

- Pursuing global travel opportunities

- Entering higher education

- Buying their first home, or in some way moving out of the family home

- Being financially independent.

Moreover, if your loved ones are keen to invest their money but aren’t sure of the “why?”, here are two prompts that could help them shape their short-term goals.

· “What would you like to do in the next five years?” – This could be travel, university, getting onto the property ladder, or entering the world of work.

· “What are your top three priorities in life right now?” – This may reduce overwhelm and help them focus on their “must-haves”.

Once these short-term targets are established, you can then help your Gen Z family members form medium- and long-term goals. Below are some prompts to help them get started.

· “What kind of profession do you want to pursue, and do you know the average salary you could earn?” – This is important because if your loved ones want to build their own business from the ground up, their investment strategy might look different to someone who wants to have a stable, salaried job.

· “Have you thought about whether you’d like to start a family in the future?” – While your child may not know the answer to this right now, saving up early for starting a family is essential. The Times Money Mentor reports that the average cost of raising a child until they’re 18 now costs more than £200,000 on average, working out at almost £1000 a month.

· “Where would you like to live long-term?” – Living in a capital city like London or New York will have different financial implications to staying in a suburban or rural area.

Before you start teaching, it’s important to listen first.

The very act of listening to your Gen Z loved ones’ goals without judgement might reassure them that you’re here to help, not to lecture.

Teach them about the 2 key pillars of investing

If you have invested assets yourself, you will know that there are a number of golden rules that seasoned investors generally follow.

Here are two “pillars” of investing to set your young family members on a solid path.

1. Diversification

One of the cornerstones of investing is diversification – and if your children and grandchildren are taking advice solely from social media and other unqualified sources, they may not be aware of the dangers of putting all their eggs in one basket.

Fortunately, explaining the rules of diversification is relatively simple – especially in today’s market climate. Show your child the performance of any single index or fund over the last three years, and they are likely to see the graph lines fluctuate up and down in quite an extreme way.

So, using the market volatility of the last three years to teach your children about diversification could be constructive. Although it may be exciting to invest heavily in an asset that perhaps has become a “trend”, including some cryptocurrencies, your children should be aware that a lack of diversification could mean they are exposing their wealth to more risk.

2. Focus on time in the market, not timing the market

It could be helpful to remind your Gen Z loved ones that they may need to adjust their thinking into a long-term framework.

Indeed, investing is a long-term endeavour, so even if your children enjoy day trading with small amounts, perhaps remind them that their portfolio should be set up to serve them decades, not months, in the future.

If your children see investing as a “game” that involves timing the market, their efforts to grow their wealth may be limited by such an approach.

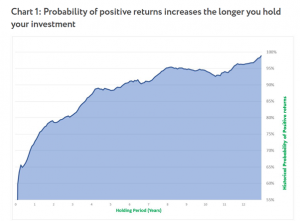

The below graph shows the results of an investing study that looked at almost 50 years of market data.

Source: Nutmeg

As you can see, the longer an asset was held for, the greater the likelihood that it would offer positive returns.

Using visual aids like this could help your Gen Z family members see the importance of long-term thinking when they invest – and may dissuade them from spur-of-the-moment buying and selling.

Introduce them to experienced financial professionals

With the absence of a professional at hand, it’s truly understandable that a Gen Z individual would turn to social media for financial advice.

Nevertheless, relying on internet “advisers” to manage their money could lead your children and grandchildren down an unsafe path.

Instead, introducing your Gen Z loved ones to a Kellands financial planner could be constructive now and over the long term. Starting on their comprehensive financial planning journey could give your loved ones a sense of direction with their money, and equip them with the knowledge to build a robust portfolio.

Get in touch

To discuss helping your Gen Z family members on their financial planning journey, or for any other family financial planning queries, email us at hale@kelland.co.uk, or call 0161 929 8838.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Crypto assets are not regulated financial products so please be aware that trading them carries a considerable amount of risk for your capital. Cryptocurrencies are also not covered by existing consumer protection laws.