How the property market has shifted since the start of 2022

As high inflation and a rising base rate contribute to the cost of living crisis, find out how the property market fared in the first half of 2022

As 2022 has progressed, the UK’s property market has defied predictions, continuing the steady house price growth the country has witnessed since June 2021.

Indeed, despite challenging economic circumstances, including a rising base rate in response to high inflation, the Russian invasion of Ukraine, and high energy prices, the property market continues to boom. However, this may only be for the time being, as many experts predict it may slow in the second half of the year.

Read on to find out all you need to know about house prices and mortgages so far in 2022, and how we can help make your property dreams come true, no matter the climate.

House prices have steadily increased throughout 2022

House prices have continued to steadily rise throughout the year.

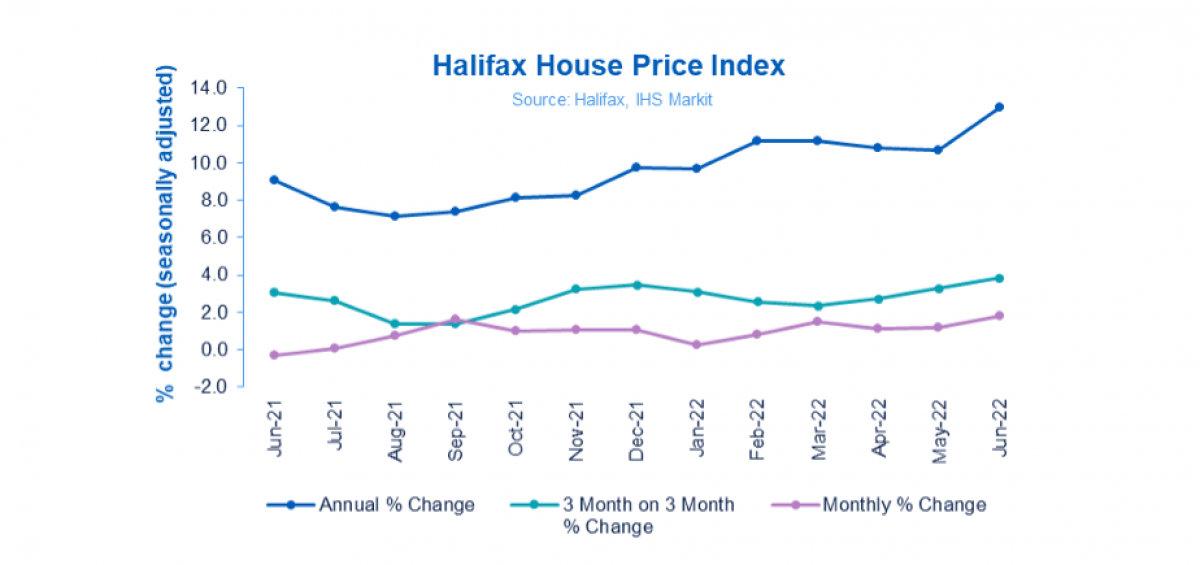

According to the Halifax House Price Index, house price growth hit 13% in the year to June 2022, its highest annual increase since 2004.

The index claims a typical UK property costs £294,845, with Halifax’s managing director, Russell Galley, stating that “the housing market defied any expectations of a slowdown, with average property prices up 1.8% in June”.

The below table depicts the annual, quarterly, and monthly percentage changes of UK house prices according to the index.

Source: Halifax

Source: Halifax

This continued rise persists despite the volatile economic circumstances presented by multiple external factors, including the pandemic and the Ukraine war.

Buyer demand remains high, despite 5 consecutive base rate rises since December 2021

Property company Rightmove reports that although buyer demand for each property was down by 8% in May 2022 compared to April, it remains 6% higher than in 2021, and 113% higher than the pre-pandemic five-year May average.

This may come as a surprise to you, as the Bank of England (BoE) has implemented five continuous base rate rises between December 2021 and June 2022, raising it from 0.1% to 1.25% within that period.

A continuously increasing base rate could mean mortgage rates are higher than they were last year – but so far, these hikes don’t appear to have dampened buyer demand by a significant margin.

The high buyer demand the UK is experiencing could come down to multiple factors at play, including:

- A high number of properties becoming available: Rightmove reports that the number of properties on the market has increased by 7% since last June, although this is still an 11% decrease from those available in 2019.

- Increased purchase times: the report claims it now takes 150 days to complete a sale – 50 days longer than in 2019. This could mean homebuyers are initiating the process as early as possible, further pushing up demand at the start of the year.

- Families looking to move after the pandemic: after the various lockdowns that placed strain on households in 2020 and 2021, families could now be looking for a change in environment.

- Increased residual savings from lockdown: the Guardian reports that Brits built up their savings to the second highest level on record in early 2021. So, it may be that some families have built up a significant deposit in recent years, and are now ready to take the next step.

All these factors could be contributing to the sustained buyer demand, despite rising costs around the UK.

Experts predict the housing market could slow in response to rising inflation

Rightmove’s research claims that while house prices are continuing to rise around the country, this growth is slowing.

According to the report, a further slowdown is predicted, due to the “affordability constraints” that may “have an influence on market behaviours in the months ahead”. This claim refers to the rising inflation rate in the UK, which according to the Office for National Statistics (ONS), in June 2022, stood at 9.4%.

If demand lowers as a result of high inflation, it could be that house price rises slow as a result. However, it is never certain how the housing market will behave; as we observed in the first half of the year, the predicted slowdown did not occur with the same velocity as expected.

Mortgage rule changes mean you could more easily access the mortgage you want

When it comes to mortgages, the BoE has scrapped the rule introduced in 2014 that required lenders to conduct an interest “stress test”. This stress test was implemented to ensure borrowers could afford their mortgage if interest rates increased.

Indeed, the Financial Policy Committee (FPC) proposed this change in February 2022, which was then confirmed in June.

If you are buying a home this year, your mortgage application may no longer be subjected to these checks; however, the BoE claims that the remaining affordability criteria “ought to deliver the appropriate level of resilience to the UK financial system”.

Working with an expert can help you make informed decisions when buying a home

If you are considering moving homes or buying a second property this year, it is important to understand how the market environment might affect this process.

For example, with the BoE’s removal of the stress test, you could be able to borrow the amount you need to secure the home you want. On the other hand, you might have concerns about affordability in the future – which is where your Kellands mortgage expert comes in.

By working with our mortgage and protection adviser, Eddy Chow, you could gain valuable insights into the status of the housing market, and work towards your homebuying goals with greater confidence.

In fact, our mortgage advice has helped so many homebuyers achieve their goals that we have been shortlisted for Best Mortgage Advice Firm at the Money Marketing Awards this year.

Get in touch

For award-shortlisted mortgage guidance that could help you find the home you deserve, contact us today. Email eddy.chow@kelland.co.uk, or call 0161 929 8838.

Please note

Your home may be repossessed if you do not keep up repayments on a mortgage or other loans secured on it.

Buy-to-let (pure) and commercial mortgages are not regulated by the FCA.

Think carefully before securing other debts against your home.