Political chaos and trade wars, how does this impact your financial plan?

As we reach the end of summer thoughts naturally turn to the future. Following the political turmoil being experienced through Brexit, it may seem a relatively challenging time for investors. Kelland’s Chartered Financial Planner, Chris Bull gives us an overview on the markets and whether times are as unique as they seem.

After a prolonged run of benign and rising markets, volatility returned in October last year. We witnessed the largest fall in major markets since 2008, 12% from peak to trough in the FTSE100. Despite Brexit headlines dominating UK press, it was the heightening US and China trade wars, alongside the prospect of continuing interest rate hikes in the US which had been the primary cause.

It was ultimately all about trade. As talks between the US and China showed signs of progress, and interest rate pressure eased off in the US, markets raced on in the first half of 2019 –the FTSE 100 posted returns of 13%. It proved to be a particularly fast recovery. There is healthy support behind the market when trade talks are progressive, but similarly risks are evident when they are not, and 2018 was a healthy reminder that investing does involve risks.

Brexit continues to weigh on the UK domestic market, and perhaps the most tangible effect felt by our clients is the fall in value of the pound. Trips to the cash machine on the continent will now yield rates close to parity. News of course continues to roll in. Parliament has been prorogued, and a General Election looms. All set against the current Brexit date of the 31st October and ongoing talks with the EU.

*The UK Government is now able to borrow 10 year money at close to an all-time low of 0.45%, which is quite remarkable. Money tends to position in this space as a hedge against some of the economic risks noted above. On a more positive note, the UK stock market is starting to look good value, with forward earnings multiples trading at a 25% discount to pre referendum levels.

We live in interesting times, and during such periods it is important to remember a few comforting fundamentals to investing.

- Markets react to key news events, and quickly. The likelihood of various outcomes are priced in. Events in the news are already reflected in market values. Be sceptical of those who claim to be able look around corners, be it a friend at a dinner party, or a finance professional.

Short term market events become far less important when investing in a well-constructed and diversified portfolio. Investing over several years and beyond, allows for a calmer, more strategic view.

Market events tend to become peaks and troughs on a chart as they fade into history – they should not form the basis of financial planning decisions.

- Whether a sophisticated or a new investor, identifying an appropriate level of risk which lies within your comfort level is an essential prerequisite to taking a long term view.

If you cannot sleep at night due to worry, you are invested in the wrong risk profile. It will prove to be a long 10 years, and worse still, you risk losing your nerve at the wrong moment. Understanding how your portfolio might behave in different market environments is of key importance to accepting risk.

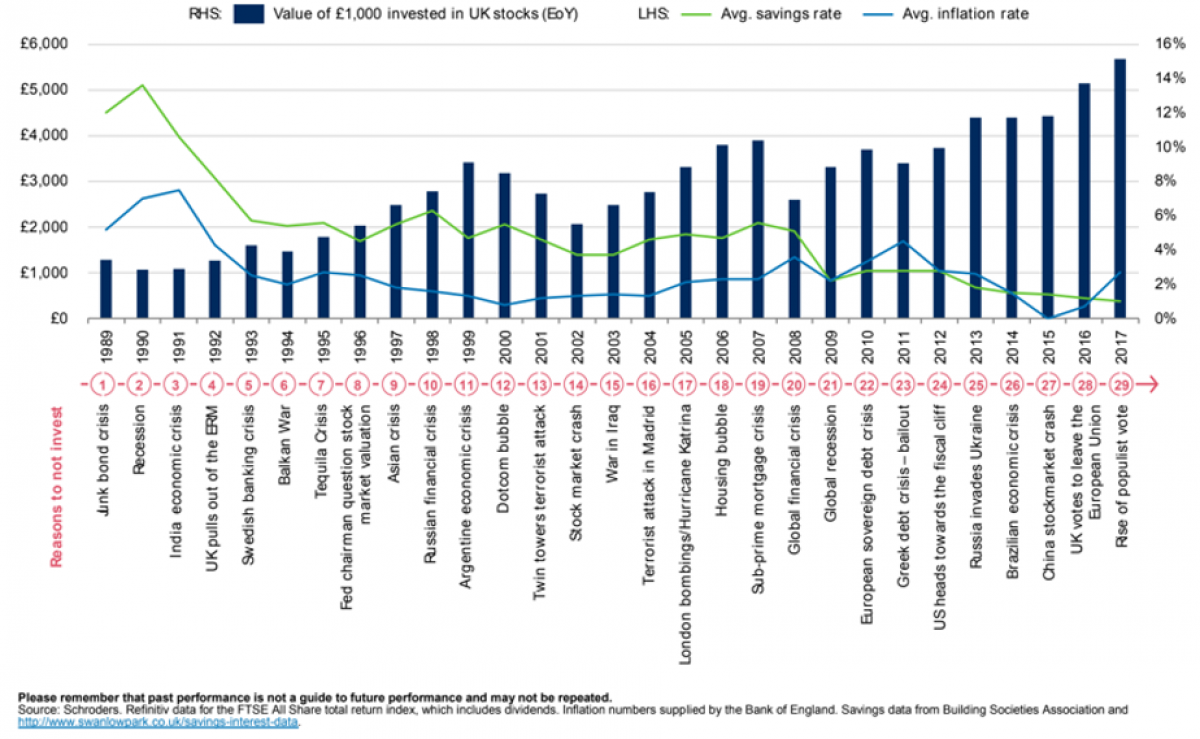

- Finally, whilst there are major global events unfolding, it is important to remember that this is a constant reality. The chart below** nicely highlights this fact.

This shows the persistent occurrence of major incidents which have impacted markets over the last 30 years. Despite these events, investing has delivered significantly better results than cash over the long term. Another clear takeaway being, there is rarely an obvious time to invest.

Now would seem a timely reminder that is ‘time in the market’, as opposed to ‘timing the market’ which matters – be stoic not flighty.

At Kellands we cut through the white noise in the media, and build strategies designed to withstand market events.

If you would like to discuss how your portfolio is positioned in the context of your requirements, and todays markets please do get in touch.

*Sourced from Bloomberg

** Sourced from Schroders