Should you listen to stock market forecasts? 3 things to consider.

At the end of the final quarter of 2023, several global stock market indices reported positive returns.

As you can see from the below table, equity markets in the UK, US, Asia, Europe, and emerging market nations almost all reported quarterly and annual upswings.

| UK FTSE All-Share | Japan TOPIX | MSCI Asia ex-Japan | FTSE Europe ex-UK | MSCI Emerging Markets | US S&P 500 | |

| Q4 2023 | 3.2% | 3.4% | 1.9% | 7.6% | 3.3% | 6.9% |

| Whole of 2023 | 7.9% | 13.3% | 0% | 15.7% | 3.6% | 19.2% |

Source: Schroders

These returns came as welcome news to investors who had experienced widespread volatility since the Covid-19 outbreak of 2020.

Importantly, the upswings witnessed towards the end of 2023 prompted stock market forecasters to make positive predictions for 2024 market conditions.

According to Forbes, several analysts have forecast double figure returns for the US S&P 500 index. Similar forecasts have been made for UK markets too, setting a very optimistic tone for investors this year.

Yet as you may already know, trying to predict the stock market is often like trying to control the weather – despite their best efforts, forecasters have no real way of knowing what will happen in the future.

So, should you listen to market forecasts as an investor? Here are three things to consider.

- Unexpected global events often affect market performance

We all remember just how abruptly Covid-19 appeared in our lives, and indeed, similar global events could have an impact on the stock market.

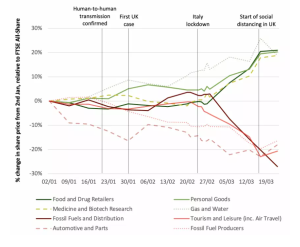

For instance, the Institute for Fiscal Studies (IFS) has documented how UK FTSE All-Share company share prices changed between 2 January to 23 March 2020.

Source: IFS

As you can see, several sectors saw huge downswings when lockdown measures began to be implemented, especially the fossil fuel and tourism industries. On the other hand, food and drug retailer share prices soared.

While the Covid-19 pandemic may be an extreme example of a global event shocking the stock market, other ongoing world events could have a similar effect. These include:

- Elections. The US will hold a general election in November 2024, and we’re likely to have one before January 2025 here in the UK. Any political shifts that happen could have a knock-on effect on investor behaviour.

- War. Escalating conflict in the Middle East alongside the Ukraine war could have an impact.

- The cost of living. While the cost of living appears to be easing off again, there is no certainty that it will not rise again, which could then sway investors’ choices.

Moreover, it may help to remember that while forecasts may give a general overview of what’s expected in the coming year, they do not usually take these types of events into account.

- Looking behind the headline figures might reveal a different story

Glancing at market predictions might give you a taste of what could be on the horizon, but if you delve into the data behind these forecasts, you might realise that they are based on a number of assumptions that are not guaranteed.

For instance, 2023 saw the US S&P 500 index perform very well, returning 19.2% by the end of the year. But in fact, there are seven key technology stocks that are largely propping up this success.

These have been nicknamed the “Magnificent Seven”, as they each hold enormous weight in US and global stock market values:

- Alphabet (Google’s parent company)

- Meta (formerly Facebook)

- Tesla

- Amazon

- Nvidia

- Microsoft

- Apple

Crucially, according to a Reuters report, the Magnificent Seven were responsible for nearly two-thirds of the S&P 500’s 24% surge earlier in 2023. In fact, 72% of S&P 500 shares “underperformed” in 2023 – yet the index still posted enviable returns at the end of the year due to the unbelievable success of the Magnificent Seven.

It is important to understand here that the positive S&P 500 forecasts for 2024 are partially based on the hugely positive performance of these seven large cap technology stocks. If just one of them experienced a hit – a change in top management, a media scandal, or simply a fall in profits – the entire index could be affected.

That does not mean that these stocks are “dangerous”, or that you shouldn’t invest in them. It simply means that being aware of the data behind headline forecasts could help you make more informed choices as an investor.

- Acting on short-term forecasts may not be in your best interest

There is nothing wrong with perusing stock market forecasts at the beginning of the year, but acting on them might not be in your best interest.

Remember, investments should normally be held for a minimum of five years, and ideally far longer than that. So, chopping and changing your investment strategy based on predictions from market analysts could put your portfolio at unnecessary risk.

This is not to say that you can’t discuss any forecasts you read with your Kellands financial planner, or take on new investment opportunities that you read about. Yet it is important to understand that acting on investment trends unadvised could lead to disappointment, so it may help to talk through your plans with a professional first.

Get in touch

Our seasoned financial planners are well equipped to help you manage your investment portfolio over the long term. Email us at hale@kelland.co.uk, or call 0161 929 8838.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.