You may be paying too much money into your pension. Here’s why

Since the Lifetime Allowance has been frozen until 2026, you could be paying too much into your pension. Find out all you need to know here.

As soon as you begin your career, pension contributions will make up a big part of your financial plan. Whether or not you have already sought advice regarding your pension, it is likely you will have been making pension contributions for many years already.

If you have always been employed, it is likely your employer has made contributions on your behalf – and you may have increased these monthly payments as much as possible in order to save for your retirement.

Similarly, if you are self-employed, you may already have a private pension pot, or several, that you regularly pay into.

Of course, making pension contributions is of the utmost importance if you are going to retire comfortably with the lifestyle you want.

However, there is one key allowance that should be considered when investing in your pension over a period of decades: the Lifetime Allowance (LTA).

The Lifetime Allowance has been frozen until 2026, leading to further charges

The LTA is the amount under which you can contribute into your pension over the course of your lifetime while receiving tax relief. If you exceed the LTA amount, you could be subject to a 55% tax charge when you draw your pension (more on this later).

As you recently read, this allowance has been frozen until 2026, along with other key tax thresholds.

Indeed, when the LTA was established in 2006, it stood at £1.5 million. After initially increasing to the peak of £1.8 million in 2010/11, it fell to £1 million in 2016/17 before rising in line with inflation until 2021/22. It will now remain at £1,073,100 until April 2026 rather than rising in line with inflation.

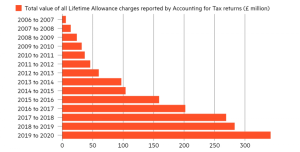

So, as you may expect, the number of people exceeding the LTA is increasing, meaning more people are paying tax charges when they come to draw from their pension fund. The below table indicates the amount taken each year in LTA charges.

Source: Investors’ Chronicle

As you can see, LTA charges surpassed £300 million in the 2019/20 tax year. If you have been contributing into your pension over the course of a long career and are approaching retirement, it could be that you are in danger of surpassing the LTA limit and incurring a large tax bill in the process.

Luckily, your Kellands financial planner can help. If you are close to exceeding the LTA and still want to save towards your retirement, there are steps you can take to protect your wealth against an unnecessary tax bill.

3 ways to protect your pension from a Lifetime Allowance tax charge

1. Apply for LTA protection

LTA protection, which can be obtained through HMRC, provides relief for those whose savings were affected by the LTA reduction that occurred in April 2016. There are two types of protection you can apply for, detailed in the table below.

| Protection | What it does | Can I keep building up my pensions? |

|---|---|---|

| Individual protection 2016 | Protects your LTA to the lower of:

|

Yes. But you must pay tax on money taken from your pension savings that exceed your protected LTA. |

| Fixed protection 2016 | Fixes your LTA at £1.25 million. | No, except in limited circumstances. If you do, you’ll:

|

Source: HMRC

This protection could provide you with the peace of mind that your pension is protected from a high tax charge if it exceeds the current limit. If you believe you are eligible for LTA protection, it may be wise to speak to your Kellands financial planner for guidance before applying.

2. Save for retirement outside of your pension pot

While your pension pot is likely to make up the majority of your retirement income, there are other avenues to explore when it comes to saving for later life.

If you are close to retiring, you could discuss short-term investment options with your financial planner, for example, that might enable you to yield returns by the time you stop working. Or, if you are a little way off retirement, long-term investments can be lucrative, and might provide a supplementary retirement fund down the line.

For example, any money you invest in an ISA will grow free of Income Tax and Capital Gains Tax.

In addition, there could be opportunities to save through real estate investments, such as obtaining buy-to-let properties, or selling your larger family home for a smaller one when you retire.

It is important to remember that your pension is not your only savings option when it comes to funding your retirement. If you want to explore other options to avoid exceeding the LTA, speak to your Kellands financial planner for guidance.

3. Draw your pension as income, instead of a lump sum

As you may already know, the LTA tax charge differs depending on how you draw your pension. Indeed, in the 2022/23 tax year, the LTA tax sits at:

- 55% if you take your pension as a lump sum

- 25% if you take your pension as income.

So, if your pension has already breached the LTA limit of £1,073,100, it could be constructive to consider drawing your pension as income. And if you had originally planned to take it as a lump sum, it may be helpful to discuss readjusting your plans with your financial planner. Although it may not be ideal to incur a tax charge when drawing your pension, reducing your LTA tax bill by up to 30% (plus Income Tax on any income drawn above the LTA) could help you remain financially viable in retirement.

Get in touch

Carefully managing your finances is crucial as you head into later life. For guidance on keeping your pension as tax-efficient as possible, or for any other financial queries, email us at hale@kelland.co.uk, or call 0161 929 8838.

Please note

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Levels, bases of and reliefs from taxation may be subject to change and their value depends on the individual circumstances of the investor.

Workplace pensions are regulated by The Pension Regulator.